Level 1

Tax Administration Associate

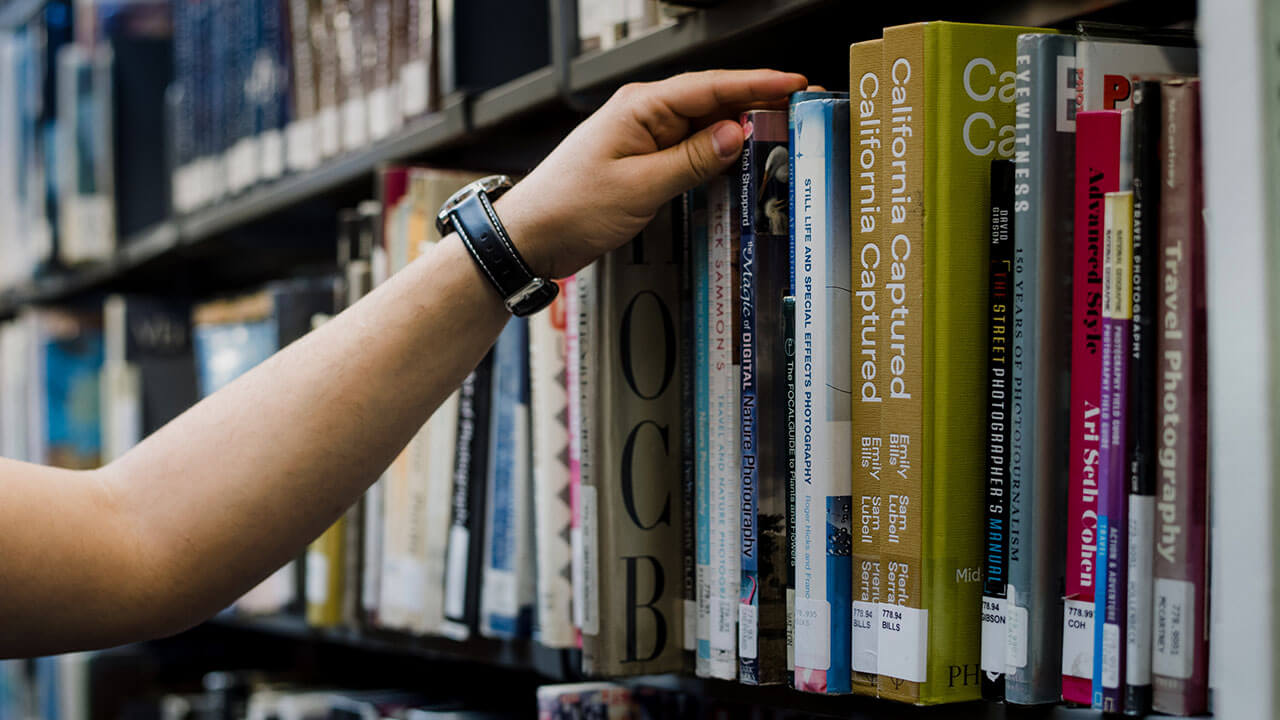

Build Your Foundation in Tax Compliance

The Tax Administration Associate program is designed to introduce learners to the Philippine tax system and the administrative responsibilities of taxpayers. This is the ideal starting point for students, support staff, and individuals new to tax-related roles.

Who Should Enroll:

- College students in business, accountancy, or legal studies

- Beginners in taxation or small business owners

- Office and admin staff involved in tax-related functions

- Government personnel needing orientation on tax duties

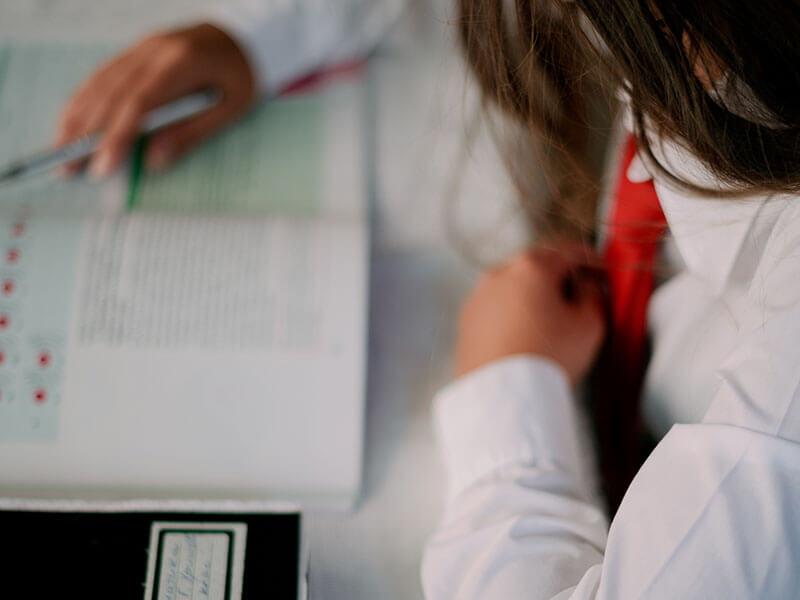

What You’ll Learn

-

Structure and roles of the Bureau of Internal Revenue (BIR)

-

Taxpayer classifications and registration requirements

-

TIN application, COR, and BIR form identification

-

Understanding basic income and business taxes

-

Deadlines, filing procedures, and recordkeeping

-

Intro to taxpayer rights and remedies

Program Details:

Duration: 12–16 hours | Self-paced

Delivery: Online

Certificate: Digital certificate upon passing final assessment

Start your tax learning journey today. Enroll in CTAA.

Tuition & Financial Aide

Join 1000s of students learning at the National Institute of Taxation. Enroll Now!

Vivamus id gravida mi, nec ullamcorper purus. Suspendisse ut nibh sagittis lacus viverra aliquam. Praesent ac lobortis mauris, non imperdiet quam. Praesent laoreet elit nisi, id feugiat ante accumsan sed. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae.

Divi University

Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia Curae; Donec velit neque, auctor sit amet.